Alphabet, Google's parent company, saw its shares rise over 3% after releasing its earnings report, which showed increased spending on AI and rising returns. The company raised its 2025 capital spending forecast to $85 billion and reported a 32% jump in cloud-computing revenue, surpassing expectations. Google's AI investments, including its Gemini model, are paying off, with 450 million monthly users. The company's ad business also performed well, with a 10.4% revenue increase. Despite this, some analysts warn that higher spending may draw scrutiny from investors, and regulatory battles could impact the company's stock price.

Read full article

July 24, 2025 • By ETtech

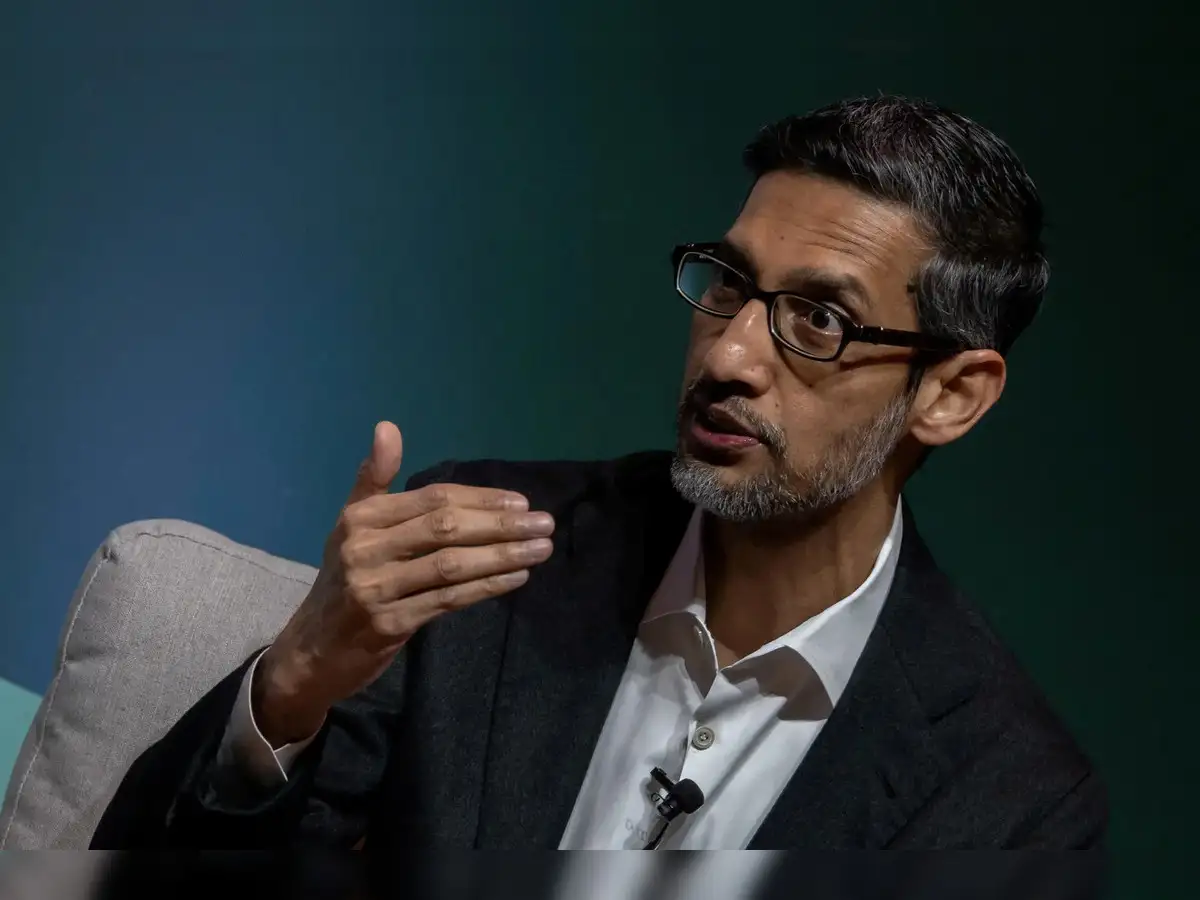

Alphabet, the parent company of Google, has reported a 19% year-on-year increase in its net profit for the April-June quarter to $28.2 billion. The company's revenue rose 14% to $96.4 billion, driven by Google Cloud sales, which jumped 32% year-over-year to $13.62 billion. Alphabet's CEO, Sundar Pichai, attributed the strong performance to the positive impact of artificial intelligence across its products. The company is increasing its capital expenditure guidance for 2025 to $85 billion to meet escalating cloud demand. Additionally, Google's AI Mode, launched in the US and India, is "going well" with over 100 million monthly active users. YouTube's ad revenue reached $9.8 billion during the second quarter, and Alphabet's Other Bets generated $373 million in revenue.

July 24, 2025 • By Conn Ó Midheach

Here is a concise summary of the news article: PayPal is creating 100 high-tech jobs in Dublin, Ireland, as it establishes a new artificial intelligence (AI) fraud and data science centre. The company, which already employs 1,500 people in Ireland, is hiring for roles in AI engineering, data science, software development, risk modelling, and cybersecurity. The new jobs will be located at PayPal's headquarters in Dublin and will support areas such as loss prevention and customer experience enhancement. This move comes after PayPal shed almost 300 jobs in Ireland last year.

July 24, 2025 • By Huhtamäki Oyj

Huhtamaki Oyj, a global provider of sustainable packaging solutions, has released its half-yearly report for 2025. Despite market uncertainty and challenges, the company's comparable net sales remained close to the previous year's level. Adjusted EBIT decreased by 1% in the first half of the year, mainly due to negative currency impacts and increased labor costs. The company has focused on executing its strategic priorities, strengthening its business, and driving productivity. It has also completed an organizational change, streamlining decision-making and increasing agility. Huhtamaki acquired Zellwin Farms, a US-based egg packaging manufacturer, and completed a three-year EUR 100 million efficiency program ahead of time. The company remains committed to navigating market uncertainties and driving sustainable, profitable growth. The outlook for 2025 remains unchanged, with the company expecting relatively stable trading conditions and a good financial position to address profitable growth opportunities.

July 24, 2025 • By Vanessa Battaglia

The Trump administration was criticized for pausing weapons shipments to Ukraine, but a review found that the pause was temporary. The author argues that the US should prioritize its own defense needs over exporting weapons to other countries, citing the time and resources required to build and maintain these systems. The author suggests that the US should focus on rebuilding its own defense capabilities, including manufacturing and critical infrastructure, rather than providing weapons to other nations. This approach would prioritize national defense and security over international obligations.

July 24, 2025 • By Barbara Moens

The EU is increasing efforts to reduce its dependence on US tech companies, driven by concerns over data privacy and security. The bloc's leaders are exploring ways to promote European tech companies and reduce reliance on US firms like Amazon, Microsoft, and Google. The EU's new tech commissioner, Henna Virkkunen, has added "tech sovereignty" to her title, focusing on areas like quantum computing, AI, and semiconductors. However, Europe faces challenges in developing its own tech industry, including a lack of alternatives to US companies, regulatory uncertainty, and limited financing options. Some propose "Buy European" provisions to favor European companies in public procurement, while others argue this could lead to protectionism. Big Tech companies are responding with "sovereign cloud" offerings, designed to keep data and operational control within specific geographies. The debate highlights the need for Europe to invest in its own tech capabilities to remain competitive and secure in the digital age.

July 24, 2025 • By Bloomberg

Alphabet Inc. said demand for artificial intelligence products boosted quarterly sales, and now requires an extreme increase in capital spending heightening pressure on the company to justify the cos…

July 24, 2025 • By ANI

The Indian IT sector is expected to see flat revenue growth of 0-2% in the current financial year due to macroeconomic uncertainties and cost pressures. Despite challenges, IT companies are investing in areas like cloud transformation, data analytics, and AI to stay competitive. The sector has strong long-term growth opportunities, but rising uncertainty in the US market is a concern. The IT-software industry is re-aligning its offerings to cater to evolving client requirements, and a healthy deal pipeline offers hope for revenue visibility in the coming quarters.

July 24, 2025 • By Shain Singh, principal security architect and innovation ambassador

Here is a concise summary of the news article: Organizations deploying AI applications face unique security and delivery challenges due to non-deterministic responses and multi-source data integration. Traditional security tools struggle with AI's variability, creating new attack vectors. F5's AI Gateway addresses these challenges by providing specialized protection, acceleration, and observability for AI applications. It monitors AI traffic, detects and blocks attacks, and identifies and scrubs personally identifiable information from AI-generated content. The solution integrates with F5's NGINX and BIG-IP platforms, extending proven application delivery capabilities to AI workloads. It also offers resource management, semantic caching, and observability to optimize AI operations and reduce costs. With the AI Gateway, organizations can maintain consistent performance, control costs, and ensure compliance with regulatory requirements.

July 24, 2025 • By Reuters

Alphabet, the parent company of Google, has seen a significant surge in cloud computing demand, leading to an increase in capital spending to around $85 billion. The company's revenue and profit exceeded Wall Street estimates, driven by strong growth in Google Cloud sales, AI features, and a steady digital ad market. Despite initial dips, Alphabet's shares rallied due to the strong cloud demand details.

July 24, 2025 • By AP

Alphabet, Google's parent company, reported strong Q2 growth with profits up 19% to $28.2 billion, driven by AI advancements across Google's services. Revenue climbed 14% to $96.4 billion, exceeding analysts' projections. Google's AI-powered search and cloud businesses continue to fuel revenue and market resilience, despite competition and regulatory threats. However, rising capital spending and looming US antitrust rulings cloud the company's future. Alphabet's stock initially dipped due to the increased spending but rose by over 2% after executives elaborated on Google's AI progress. The company is investing heavily in AI to fend off competition from startups like OpenAI's ChatGPT. A federal judge is weighing countermeasures, including requiring the sale of Google's Chrome browser, which could impact the company's future.

July 24, 2025 • By research@specstream.ai

Researchers have introduced a new method called Speculative Streaming, which accelerates Large Language Model (LLM) inference by 2.8x with a 99.99% reduction in parameters. This approach, based on the research paper by Bhendawade et al. (2024), eliminates the need for auxiliary draft models by integrating the drafting capability directly into the target model. The method achieves comparable or superior speedups to existing techniques while using significantly fewer additional parameters, making it practical for resource-constrained deployments. Speculative Streaming maintains the same output quality as the base model and has been validated across multiple domains, including summarization, structured queries, and meaning representation tasks. This innovation reduces deployment complexity, memory requirements, and computational overhead, making advanced LLM acceleration accessible to smaller organizations and edge devices. The implementation, called SpecStream, supports various model architectures and is licensed under the MIT License.

July 24, 2025 • By AFP

Here is a concise summary of the news article: Alphabet, Google's parent company, reported a $28.2 billion profit on $96.4 billion in revenue, driven by AI advancements across its business. Strong growth in search, YouTube, and cloud services boosted results. However, antitrust rulings in the US threaten Google's dominance, with potential break-ups looming. Google is appealing both court decisions. The company will spend $10 billion more on capital expenditures this year to meet growing demand for cloud services. Alphabet's cloud computing business is on pace to bring in $50 billion this year. Despite antitrust battles, Google's advertising business remains strong, with ad revenue at YouTube continuing to grow.

July 24, 2025

Here is a concise summary of the news article: Alphabet's second-quarter earnings beat expectations, despite announcing a $10 billion increase in spending on infrastructure and artificial intelligence. Investors responded positively, with shares rising 3% in extended trading. In contrast, Tesla's second-quarter earnings missed expectations, with a 16% year-over-year decline in automotive revenue. The Nasdaq Composite closed above 21,000 for the first time, and the S&P 500 and Dow Jones Industrial Average also rose. Additionally, there is growing interest in "neocloud" companies, which specialize in artificial intelligence cloud computing and are seen as more cost-effective than traditional hyperscalers.

July 24, 2025 • By Patrick Tucker

The White House has released a plan to achieve global dominance in artificial intelligence (AI). The plan aims to accelerate military adoption, fast-track permits for data centers, support open-source models, and take other steps. It also grants the Defense Department priority access to commercial cloud computing in times of crisis. The plan has been met with approval from some military and technical experts, but others have voiced concerns about its potential threats to civil liberties and national security. Some of the key provisions of the plan include: * Building a virtual proving ground to test new autonomy and AI solutions * Creating AI innovation and research hubs at senior military colleges * Imposing tracking requirements for advanced chips and calling for location verification features on advanced AI compute * Urging the United States to retake leadership in international standards-setting bodies The plan has been praised by industry-aligned groups, but critics argue that it could threaten civil liberties and privacy by eliminating regulations that may "unnecessarily hinder AI development or deployment." Some states have passed or are considering legislation to restrict uses of AI, including facial recognition for law enforcement, and the plan's provisions could pressure states to abandon these restrictions or risk losing federal funding. Overall, the plan aims to position the United States as a leader in AI, but its implementation and potential consequences are still being debated.

July 24, 2025 • By Ghazal Ahmed

Here is a concise summary of the news article: Scotiabank analyst Nat Schindler raised Amazon's price target to $275 from $250, maintaining a "Sector Outperform" rating. Despite mixed investor sentiment ahead of Q2 results, Amazon is expected to have the weakest sentiment among hyperscalers. Amazon Prime Day achieved record sales, surpassing previous four-day events. However, Scotiabank notes potential margin pressure for Amazon Web Services (AWS) due to capacity constraints. Investor concerns about Amazon's AI development, particularly compared to Google, have also been acknowledged.

July 24, 2025 • By PYMNTS

Alphabet, Google's parent company, has increased its projected capital expenditures to $85 billion in 2025, a 62% rise from 2024. This increase is mainly due to investments in AI infrastructure to meet growing demand from cloud customers. In the second quarter, Google Cloud revenues increased 32% to $13.6 billion, with a backlog of customer orders. Alphabet's CEO, Sundar Pichai, stated that the company is building an installed base and making efficient investments to grow the cloud business, expecting a healthy return on investment. The company's net income rose 19% to $28.2 billion, beating consensus forecasts. Despite this, shares of Alphabet fell 1.3% in after-hours trading.

July 24, 2025

Microsoft and Red Hat have collaborated to bring new technical integrations, including the full certification of SQL Server 2022 on Red Hat Enterprise Linux (RHEL) 9. This certification allows organizations to run SQL Server 2022 as a confined application on RHEL 9, providing stronger security boundaries and tighter integration with enterprise identity systems. Additionally, the companies have introduced a validated pattern for retrieval-augmented generation (RAG) using open-source large language models (LLMs) deployed on Red Hat OpenShift with Azure. This solution provides an architecture for deploying scalable LLM-based applications that combine private data with generative AI, running on trusted Red Hat infrastructure and the scalability of Microsoft Azure. The validated pattern is production-ready, open-source, and combines automation, documentation, and best practices into a reusable, GitOps-based framework. It enables the automatic deployment of a full application stack while supporting continuous integration (CI) and business-centric use cases. The pattern integrates with Azure SQL, providing improved security and simplicity in administering embeddings and RAG content. This collaboration allows enterprises to build and scale generative AI solutions with a powerful, production-ready foundation. The validated pattern on Red Hat OpenShift makes deploying these solutions repeatable and more consistent, while Azure SQL and SQL Server 2025 deliver high-performance storage for vector data and embeddings.

July 23, 2025 • By Justin Diaz

RICH Miner has upgraded its XRP cloud mining service, allowing users to invest their XRP coins and receive daily income in USD stablecoins. This automated passive income model enables users to earn money without operating or transacting. XRP is not a traditional mineable currency, but RICH Miner has innovatively connected it to the cloud mining system, allowing users to purchase BTC computing power contracts and participate in Bitcoin mining. The platform provides strong liquidity, stable returns, and all-around protection for user funds. Analysts believe this model redefines the use of digital assets and provides a new asset activation path for XRP. RICH Miner's cloud mining solution is a low-risk, high-liquidity option that fits the current macroeconomic trend, offering a stable and safe way for Ripple holders to earn daily income.

July 23, 2025 • By Maxwell Zeff

Google CEO Sundar Pichai expressed excitement about partnering with OpenAI, a major competitor in AI, to provide cloud computing resources. This partnership allows OpenAI to train and serve its AI models using Google Cloud. Despite OpenAI's ChatGPT posing a threat to Google Search, the deal marks a significant new customer for Google Cloud. Google Cloud revenue soared to $13.6 billion in the second quarter, with growth attributed to its services for AI companies. Google has been successful in winning deals with large AI labs due to its supply of Nvidia GPU chips and in-house TPU chips. The partnership may seem counterintuitive, but it highlights Google Cloud's strength in the AI era. Google's AI products, such as Gemini and AI Overviews, are also showing promise, with 450 million and 2 billion monthly active users, respectively. However, the business around these products remains unclear, and the partnership's long-term implications for Google Search are uncertain.